Solid Month Caps Positive Quarter for Markets

U.S. stock markets saw gains for the month and quarter. The Nasdaq Composite gained 0.48 percent during March. The S&P 500 and Dow Jones Industrial Average (DJIA) saw stronger results, up by 4.38 percent and 6.78 percent, respectively. On a quarterly basis, the Nasdaq Composite gained 2.95 percent, and the S&P 500 gained 6.18 percent. The DJIA led the way with an 8.29 percent return.

These positive results coincided with better-than-expected earnings growth. According to Bloomberg Intelligence, as of March 30 with 99 percent of companies having reported, fourth-quarter earnings for the S&P 500 were up by 5.8 percent. This result is much better than analysts’ initial expectations for an 8.8 percent drop.

Technical factors were also supportive for markets. Despite some volatility along the way, all three major indices remained well above their 200-day moving averages. This marks three straight quarters where the indices finished above their respective trend lines.

International markets had a similar month and quarter, with riskier assets seeing more volatility. The MSCI EAFE Index increased by 2.30 percent during the month and 3.48 percent during the quarter. The MSCI Emerging Markets Index declined by 1.49 percent in March but managed a 2.34 percent return for the quarter. Both international indices remained above their 200-day moving averages.

Fixed income markets had a more challenging time. The 10-year Treasury yield ended the month at 1.74 percent, up from 1.45 percent at the start of the month and 0.93 percent at the start of the quarter. Long-term rates rose throughout the quarter due to increased expectations for growth and inflation as the economic recovery continues. The Bloomberg Barclays U.S. Aggregate Bond Index fell by 1.25 percent during the month. This contributed to a 3.37 percent decline for the index during the quarter.

High-yield fixed income saw more positive results. The Bloomberg Barclays U.S. Corporate High Yield Index gained 0.15 percent during the month and 0.85 percent during the quarter. High-yield spreads continued to compress, ending the month at their lowest level since the start of the pandemic.

Medical Risks Back in Play

The combination of the economy reopening and the spread of more contagious variants of the virus has increased risks again. Case counts started to creep up in March, the number of tests fell, and the positive test rate increased. Vaccination efforts improved, however. We finished the month with 16 percent of the population fully vaccinated and 29 percent of the population having received at least one dose.

Economic Improvement Continues

Despite the rise in medical risks during the month, the economic data continued to improve. March’s jobs report showed that 916,000 jobs were added during the month. Much of the job gains were concentrated in the leisure and hospitality sectors. We also saw a decline in the average number of weekly unemployment claims in March.

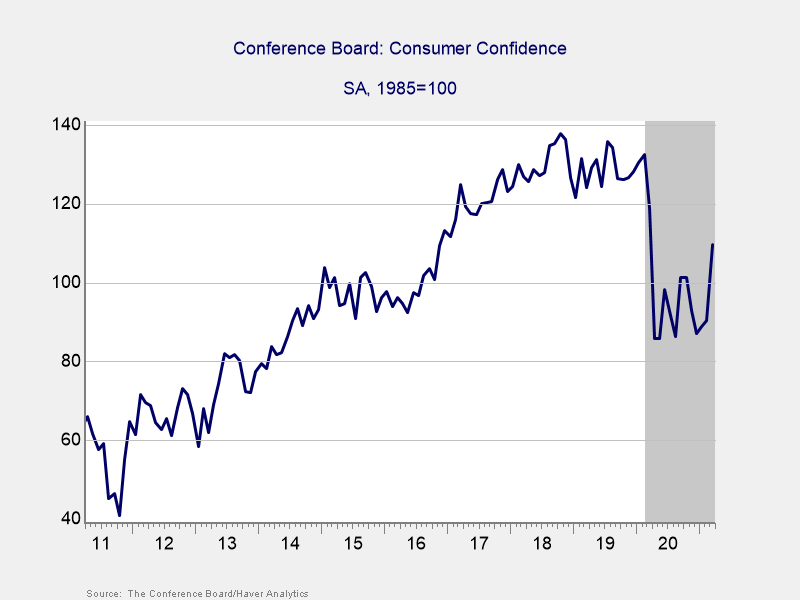

As you can see in Figure 1, the Conference Board Consumer Confidence Index hit a new post-lockdown high in March. This indicates consumers are starting to see a light at the end of the tunnel.

Figure 1. Conference Board Consumer Confidence, 2011–Present

Consumer spending saw a dip in February. It was largely due to the inclement winter weather during the month, however, as well as the fading impact from the December stimulus package. Manufacturer confidence finished the month at its highest level since 1983 due to strong buyer demand and low business inventory. Business spending saw a modest weather-related decline in February.

The Progress Is Real, but Risks Remain

We made real progress with vaccinations and the economy during the month. But even so, the rising case counts toward month-end served as a reminder that the medical risks are still out there. The economy looks to have enough momentum to ride them out until the pandemic is brought under full control, however. As always, a well-diversified portfolio that matches investor goals and timelines represents the best path forward for most. If concerns remain, contact us to discuss your financial plan.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Barclays Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg Barclays government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg Barclays U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, senior investment research analyst, at Commonwealth Financial Network®.© 2021 Commonwealth Financial Network®