June Rally Caps Solid Quarter for Stocks

Markets continued to rise, with all three major U.S. indices growing in June. The S&P 500 gained 3.59 percent in June and 4.28 percent for the quarter. The Dow Jones Industrial Average increased 1.23 percent in June, but weakness in April caused the index to fall 1.27 percent during the second quarter. The technology-heavy Nasdaq Composite led the way with a 6.03 percent gain in June and an 8.47 percent increase in the second quarter. Solid fundamentals and an improving economic backdrop helped support equity market returns in June.

According to Bloomberg Intelligence, as of June 28, with all companies having reported earnings, the average earnings growth rate for the S&P 500 in the first quarter was 7.9 percent. This is well above analyst estimates at the start of earnings season for a more modest 3.8 percent increase. The better-than-expected results were widespread; 10 of 11 sectors showed better earnings growth than anticipated. Looking ahead, analysts expect to see continued solid earnings growth through the rest of the year. Over the long run, fundamentals drive market performance, so the positive first half of the year was encouraging for investors.

Technical factors were also supportive during the month and quarter. All three major U.S. indices spent the entire quarter well above their respective 200-day moving averages. This is an important technical indicator because prolonged breaks above or below the 200-day moving average can indicate shifting investor sentiment for an index. Continued technical support and solid fundamentals helped drive the market rally in June.

Results were more mixed internationally as political concerns weighed on developed foreign stocks. The MSCI EAFE Index fell 1.61 percent in June, leading to a 0.42 percent decline for the second quarter. Emerging markets, on the other hand, were up 4.01 percent during the month and 5.12 percent for the quarter. Technical results were supportive for international stocks; both indices spent the entire quarter above their respective 200-day moving averages.

Bonds Up for the Month and Quarter

Fixed income markets also had a solid month, capping off a positive quarter. Investment-grade bond returns were supported by falling long-term interest rates. The 10-year US Treasury yield fell from 4.51 percent at the end of May to 4.36 percent by the end of June. The Bloomberg Aggregate Bond Index was up 0.95 percent for the month and 0.07 percent during the quarter.

High-yield bonds were also up for the month and quarter. The Bloomberg US Corporate High Yield Index gained 0.94 percent in June and 1.09 percent for the quarter. High-yield credit spreads ended the month virtually unchanged, signaling continued investor appetite for higher-yielding bonds despite relatively tight spreads on a historical basis.

Returns to Highlight

- Bloomberg Aggregate Bond Index: up 0.07% in the second quarter

- Bloomberg U.S. Corporate High-Yield Bond Index: up 1.09% in the second quarter

Inflation Slows

The drop in interest rates in June was due in part to signs of continued progress in the fight against inflation. Year-over-year consumer price growth rose to a 2024 high of 3.5 percent in March; however, we’ve seen steady improvements since then, with headline consumer price growth slowing to 3.4 percent in April and 3.3 percent in May. Although this is still above the Federal Reserve’s (Fed’s) 2 percent inflation target, the continued improvement was good news.

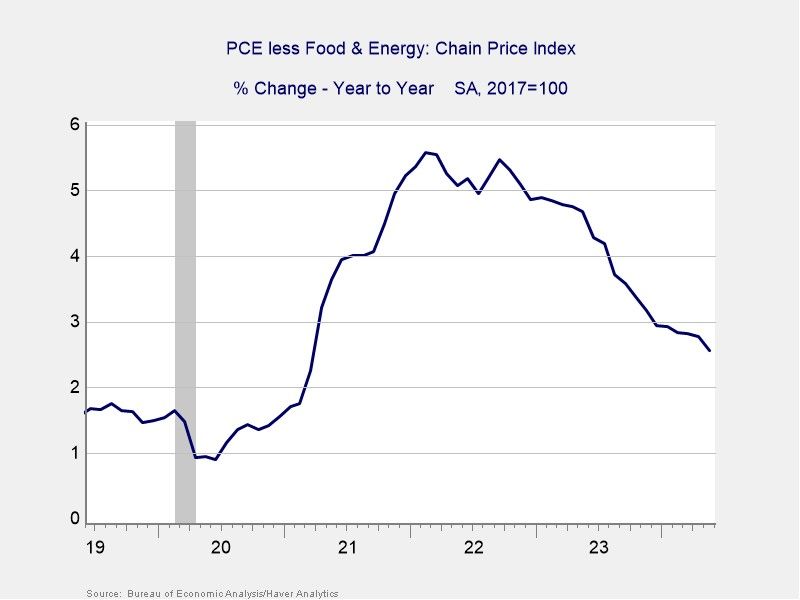

Other inflation metrics also showed signs of improvement during the month, including the Fed’s preferred inflation metric, the personal consumption expenditures (PCE) price index. Headline and core PCE growth fell to their lowest levels in more than two years in May. As you can see in Figure 1, core PCE growth has improved throughout the year, which may set the stage for interest rate cuts in the second half as the Fed closely monitors this indicator.

We ended the quarter with futures markets pricing in one or two interest rate cuts by the end of the year, with November and December appearing to be the most likely months for a potential rate cut.

Figure 1. Core PCE Price Index Year-over-Year Growth Rate, June 2019–Present

Source: Bureau of Economic Analysis/Haver Analytics

The Takeaway

- Multiple inflation metrics showed encouraging signs of improvement during the month.

- Inflation improvements caused interest rates to fall in June, which supported stocks and bonds.

Solid Economic Growth

Aside from inflation reports, other updates released during the month continued to show signs of healthy economic growth. Although hiring surprisingly accelerated in May, a rising unemployment rate during the month helped calm investor concerns about a potentially overheating job market.

Consumer spending also grew in May, with retail sales and personal spending improving after slowing in April. Both measures of consumer spending remained below their recent highs from earlier in the year; however, slower growth is still growth, and these results were welcomed by investors. Consumer spending is the primary driver of economic activity in the U.S., so these will remain important

metrics to monitor.

Business spending was also up modestly in May, with headline durable goods orders up 0.1 percent. This fits with the overall theme of slower yet potentially more sustainable economic growth in May. Looking ahead, economists expect to see solid—albeit slower—growth in the second half of the year. This would likely be a positive development for markets because slower growth would be expected to help combat inflation, which remains too high.

The Takeaway

- Economic data releases in June showed signs of healthy economic growth.

- Consumer and business spending growth remained below highs from earlier in the year, which may be a sign of more sustainable growth ahead.

- Slower growth may be welcomed by investors who remain concerned about inflation.

Market Risks to Monitor

Despite the recent improvements, inflation remains the most pressing risk for markets. We saw this in April, when a hot March inflation report caused markets to sell off. Although further progress in tamping inflation down is expected in the second half of the year, an unexpected rise in inflation would likely pressure markets.

In addition, we face considerable election-driven uncertainty—both domestically and abroad. Elections in France and the U.K. in early July highlight the international uncertainty, and domestic political uncertainty is expected to ramp up as we near Election Day in November.

Other international risks remain, too, as shown by continued conflicts in Ukraine and the Middle East. The ongoing slowdown in China is also worth monitoring given the country’s importance to global

trade and growth.

And, of course, there are also the unknown risks that could affect markets in the second half of the year.

The Takeaway

- Despite recent progress, inflation remains a pressing risk for markets.

- Election-related uncertainty remains domestically and abroad.

- Other international and unknown risks could also pressure markets in the second half of the year.

Positive Outlook for the Second Half

Although markets face very real risks, we remain in a good place to start the second half of the year. Signs of slowing yet potentially more sustainable growth in June were encouraging for investors, and this supportive economic backdrop is expected to continue into the summer months and beyond. Strong earnings growth to start the year, combined with analyst estimates for continued growth throughout the rest of 2024, is another positive development that should support markets in the months ahead. The combination of improving fundamentals and a solid economic backdrop is expected to serve as a tailwind for investors through the rest of the year.

Given the supportive backdrop, the most likely path forward for markets and the economy remains continued growth and appreciation, though we may face short-term setbacks along the way. As we saw at the start of the quarter, real work remains to return inflation to its target, and markets remain sensitive to inflation and interest rates. Although these risks should be monitored in the short run, the outlook remains positive over the long run. If concerns remain, please reach out to us to review your financial plans.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged, and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. The Core Personal Consumption Expenditure (PCE) Price Index measures the changes in the price of goods and services purchased by consumers for the purpose of consumption, excluding food and energy. Authored by Brad McMillan, CFA®, managing principal, chief investment officer, and Sam Millette, director, fixed income, at Commonwealth Financial Network®. © 2024 Commonwealth Financial Network