Mixed Month for Stocks

July was a mixed month for stocks, as investors rotated away from large technology companies into a more diversified approach. The S&P 500 gained 1.22 percent during the month while the Dow Jones Industrial Average managed a 4.51 percent gain. The technology-heavy Nasdaq Composite index lagged its peers but ended the month down only 0.73 percent following a last-day rally.

These mixed results came despite supportive fundamentals. Per Bloomberg Intelligence, as of July 31, with 58 percent of companies having reported earnings, the average earnings growth rate for the S&P 500 in the second quarter was 11.7 percent. This is above analyst estimates at the start of earnings season for an 8.3 percent increase. Over the long run, fundamentals drive market performance, so the better-than-expected earnings growth is a positive sign for investors.

Technical factors were supportive as well during the month. All three major U.S. indices spent the entire month well above their respective 200-day moving averages. (The 200-day moving average is a widely followed technical indicator, as sustained breaks above or below this level can signal shifting investor sentiment for an index.) The continued technical support in July was another positive development

for investors.

International stocks were up, with the MSCI EAFE Index gaining 2.93 percent in July while the MSCI Emerging Markets Index was up 0.37 percent. Both major international indices also received technical support as both spent the entire month above their respective 200-day moving averages.

Bond Positive

It was a good month for fixed income investors, as falling interest rates led to rising bond prices. The 10-year Treasury yield fell from 4.48 percent at the start of the month to 4.09 percent by month-end. The Bloomberg U.S. Aggregate Bond Index was up a solid 2.34 percent during the month.

High-yield bonds also had a positive start to the second half of the year, as the Bloomberg U.S. Corporate High Yield Index gained 1.94 percent in July. High-yield spreads ended the month largely unchanged, leaving them relatively tight on a historical basis.

Returns to Highlight

- Bloomberg Aggregate Bond Index: up 2.34% in the month of July

- Bloomberg U.S. Corporate High-Yield Bond Index: up 1.94% in the month of July

Inflation Cools

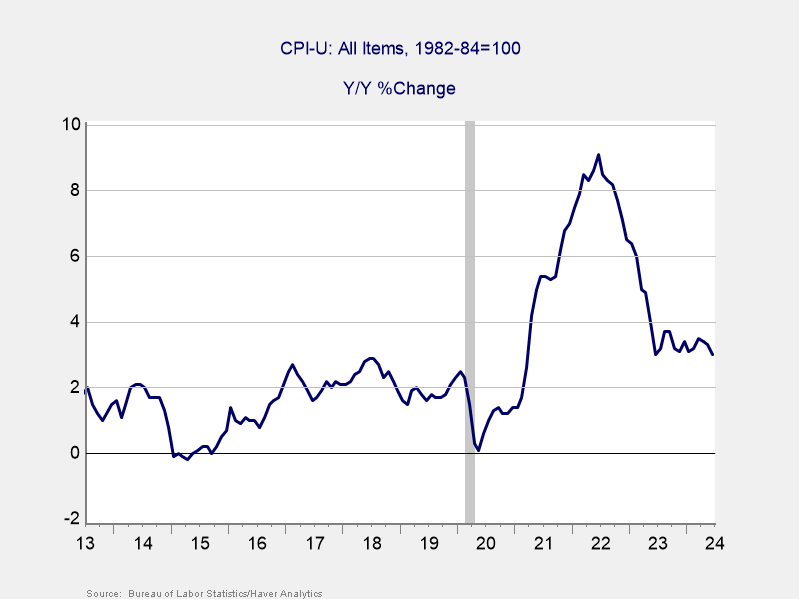

The drop in interest rates in July was due in large part to continued signs of progress in the fight against inflation. The June Consumer Price Index report showed consumer prices fell by 0.1 percent during the month. This brought the year-over-year pace of inflation down from 3.3 percent in May to 3 percent in June. As you can see in Figure 1, this is the lowest level in more than a year and now marks three consecutive months with improvements.

While there is still work to be done to get back to the Federal Reserve’s 2 percent inflation target, the improvements over the past few months have been encouraging.

Given the progress on the inflation front, investor expectations for rate cuts rose during the month. We entered July with futures markets pricing in a roughly 60 percent chance of a rate cut at the Fed’s September meeting. Following the release of the June inflation reports and the conclusion of the Fed’s July meeting, markets ended the month fully pricing in a 25 basis point rate cut in September. Fed chair Jerome Powell indicated in his post-meeting press conference that the Fed remains data-dependent when setting interest rates; however, he did note that a rate cut in September is a real possibility provided the data supports a cut.

Figure 1. CPI-U All Items, Year-Over-Year Percentage Change

Source: Bureau of Labor Statistics/Haver Analytics, July 11, 2024

The Takeaway

- Consumer inflation continued to improve in June.

- Market expectations for rate cuts rose during the month, with all eyes on the Fed’s next meeting in September.

Improving Economic Growth

The economic data releases in July showed continued signs of a healthy economic expansion. The second-quarter GDP report showed that the annualized pace of economic growth rose from 1.4 percent in the first quarter to 2.8 percent in the second quarter. This result was well above economist estimates for a more modest 2 percent growth rate and highlights the health of the continued economic expansion. Personal consumption growth rose from 1.5 percent in the first quarter to a solid 2.3 percent in the second quarter.

The June employment report showed continued hiring growth, as 206,000 jobs were added in June following a downwardly revised 218,000 in May. This headline result was a Goldilocks outcome as it represents solid employment growth without sparking fears of a potentially overheating economy. With that being said, the underlying data showed some signs of cracks in the labor market, with the unemployment rate rising to a two-year high of 4.1 percent during the month. This will be an important area to monitor in the months ahead as the Fed attempts to achieve its dual mandate of stable prices and maximum employment.

Finally, consumer spending remained solid. Headline and core retail sales came in well above economist estimates in June, with the 0.8 percent rise in core sales representing the largest monthly increase in more than a year. Personal income and spending growth also remained healthy in June. Given the importance of consumer spending on the overall economy, these updates were welcome developments.

The Takeaway

- The economic data releases in July showed signs of continued healthy growth.

- GDP growth accelerated in the second quarter.

- Consumer spending remained solid in June.

Risks Remain

While inflation has improved in recent months, it remains a risk for markets and the economy. Further progress in getting prices down is expected in the months ahead; however, there is still real work to be done to get back to the Fed’s 2 percent target and we may face setbacks along the way. Any unexpected signs of faster inflation would likely rattle markets in the short term. Additionally, economists and investors will be keeping a close eye on the labor market for any signs of further weakness.

July also highlighted the large level of political uncertainty that we face here in the U.S. This uncertainty is expected to ramp up as we approach the election in November, which could negatively impact markets later in the year.

International risks remain as well, highlighted by the ongoing conflicts in Ukraine and the Middle East as well as the continued economic slowdown in China. While the direct market impact of these international risks has largely been muted so far this year, they are a source of potential uncertainty that should be monitored going forward.

The Takeaway

- Inflation remains a real risk for markets.

- Election-related uncertainty is expected to pick up as we approach the November elections.

- International risks could also pressure markets in the second half of the year.

Encouraging Backdrop and Positive Outlook

On the whole, we remain in a relatively good place as we look to finish out the summer months. The economic backdrop remains supportive, and signs of a soft landing continue to show in the data. Company fundamentals are also healthy, signaling potential further growth and further

appreciation ahead.

While there are real risks that markets and the economy face, we’ve managed to successfully navigate through periods of uncertainty in the past and this time is no different. It’s certainly possible that we’ll face minor setbacks in the months ahead; however, we believe the most likely path forward is for continued economic growth and market appreciation. Given the potential for setbacks, a well-diversified portfolio that matches investor goals and timelines remains the best path forward for most. If concerns remain, please reach out to us to go over your financial plans.

Disclosure: This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation. Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. Authored by Brad McMillan, CFA®, managing principal, chief investment officer, and Sam Millette, director, fixed income, at Commonwealth Financial Network®. © 2024 Commonwealth Financial Network