Markets rallied to start the year, with international stocks outperforming U.S. companies. Rising long-term interest rates weighed on bond returns; however, investment-grade and high-yield bonds were still able to post modest gains for the month. Looking forward, continued economic growth and market appreciation remain the most likely path in 2026.

Beyond the Headlines: Solid Start to the Year for Markets

Markets rallied to start the year, supported by strong earnings growth in the fourth quarter. The S&P 500 gained 1.45 percent while the Dow Jones Industrial Average was up 1.80 percent. The Nasdaq Composite saw a 0.97 return in January.

These strong results were driven by healthy fundamentals. We’re in the middle of fourth-quarter earnings season, and so far so good for U.S. companies. As of January 30, with roughly one third of companies having reported actual earnings, the average earnings growth rate for the S&P 500 was nearly 12 percent. This is well above analyst estimates for a more muted 8.4 percent growth rate at the start of earnings season. Over the long run, fundamental factors drive market performance, so the continued earnings growth is encouraging. Technical factors were also supportive, with all three indices finishing the month well above their respective 200-day moving averages.

International stocks outperformed their domestic counterparts to start the year. Developed and emerging markets both rose in January, following strong returns throughout 2025. The MSCI EAFE Index gained 5.22 percent for the month while the MSCI Emerging Markets Index did even better, up 8.86 percent in January. Foreign stocks were supported by a weaker dollar and continued investor appetite for international companies as concerns about U.S. trade and fiscal policies increased during the month.

Fixed Income Update: Long-Term Yields Rise as Fed Remains on Sidelines

Bonds were also up to start the year, despite rising long-term interest rates in January. The 10-year Treasury yield rose from 4.18 percent at the start of the month to 4.26 percent by month-end, while short-term yields ended the month little changed. Despite the rising rate environment, both investment-grade and high-yield bonds were up in January.

The Bloomberg Aggregate Bond Index gained 0.11 percent during the month while the Bloomberg U.S. Corporate High Yield Index gained 0.51 percent.

The Federal Reserve elected to keep interest rates unchanged at the conclusion of its January meeting, which was in line with market and investor expectations. Looking forward, markets expect to see between two to three interest rate cuts by the end of the year, but the timing of any potential cuts remains uncertain. Toward the end of January, President Trump nominated former Fed governor Kevin Warsh to be the next Federal Reserve chair, starting in May. While this nomination is still pending confirmation from the Senate, market reaction to the announcement was muted.

Returns to Highlight

- Bloomberg U.S. Aggregate Bond Index: up 0.11% in January 2026

- Bloomberg U.S. Corporate High-Yield Bond Index: up 0.51% in January 2026

The Takeaway

- Bond returns were positive to start the year despite rising long-term rates.

- The Fed kept short-term rates unchanged at the conclusion of its January meeting.

- Former Fed governor Kevin Warsh was nominated to be the next Fed chair, starting in May pending Senate confirmation.

Economic Report Updates: Job Market Headwinds

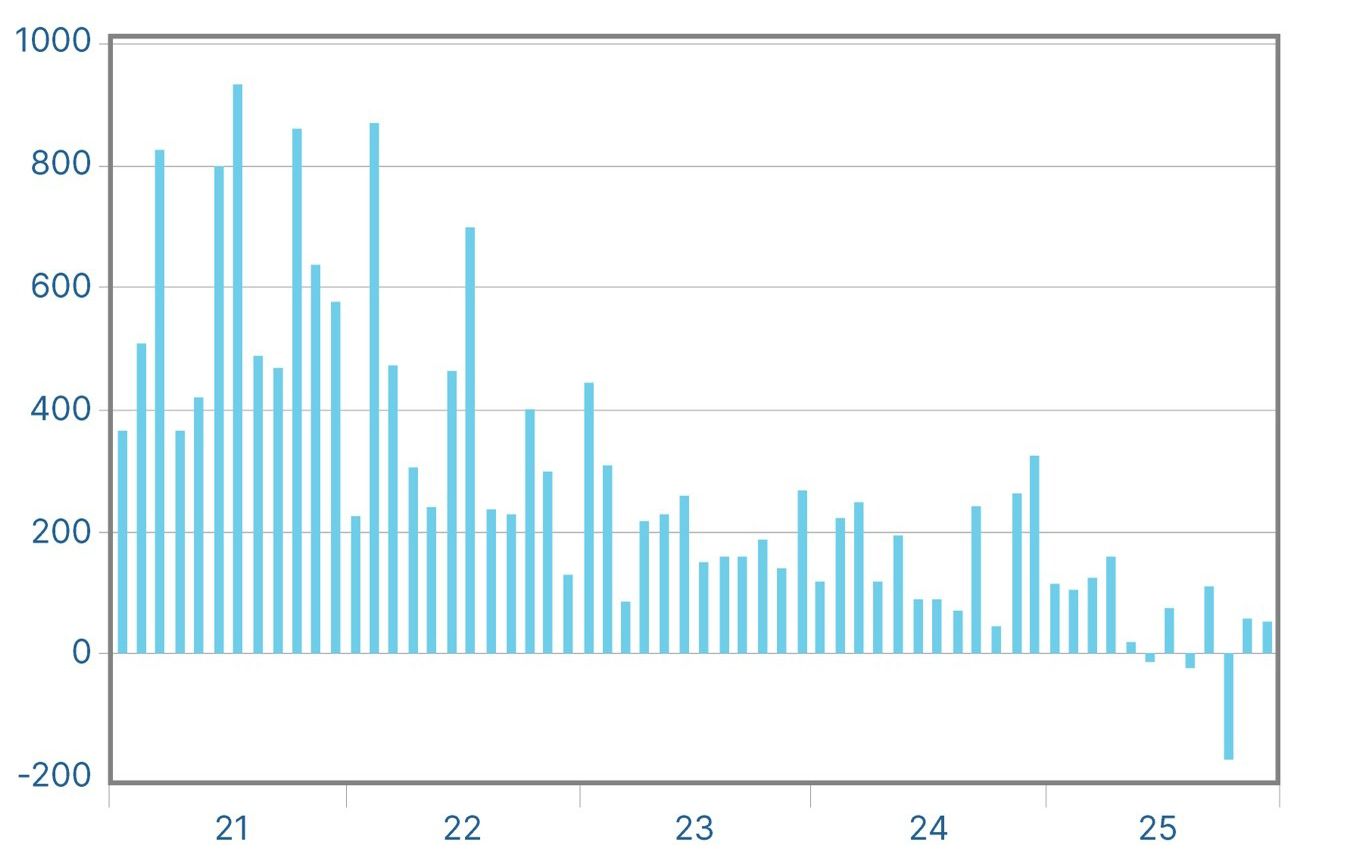

Despite the solid start to the year for markets, the economic backdrop remains challenging. The December job report showed that just 50,000 jobs were added during the month, down from a downwardly revised 56,000 in November. As seen in Figure 1, hiring slowed notably in 2025 compared to recent post-pandemic years. The weakness in the job market is a primary reason why the Fed cut interest rates at the end of 2025 and serves as a headwind for overall economic growth.

Consumer sentiment has started to reflect the weakening labor market. Consumer confidence fell in January to its lowest level since 2014, with respondents citing a worsening outlook for jobs as a major driver behind the souring sentiment. The drop in consumer confidence is concerning as it could be a sign that consumer spending growth is set to slow. This will be a key area to monitor in the months ahead given the importance of consumer spending on overall economic activity in the country.

The Takeaway

- The job market remains weak, which is a headwind for the overall economy.

- Consumer sentiment fell to its lowest level since 2014 to start the year, which is a concerning development.

Looking Ahead: Cautious Optimism Despite Risks

Aside from jobs-related headwinds, markets face a variety of risks as we kick off the new year. Geopolitical risks remain front and center, as the Greenland saga at the start of the year showed. While there appears to be little lasting impact from the headline-grabbing situation, rising political uncertainty still has the potential to negatively impact markets. While still a long way off, the midterm elections in November are expected to serve as a potential source for further political uncertainty throughout the year.

Overall, however, we remain in a solid place as we start the new year. Market fundamentals have shown impressively resilient health despite the shifting risks, and the positive momentum from 2025 appears set to carry over in 2026. While we can reasonably expect short-term bumps along the way, the most likely path forward is for continued economic growth and market appreciation.

Given this cautiously optimistic outlook, a well-diversified portfolio that aligns investor goals and risk tolerance remains the best path forward for most. As always, if concerns remain, please reach out to us to go over your financial plans.

Disclosure: This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation. Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. One basis point (bp) is equal to 1/100th of 1 percent, or 0.01 percent. Authored by Chris Fasciano, chief market strategist, and Sam Millette, director, fixed income, at Commonwealth Financial Network®. © 2026 Commonwealth Financial Network®