Strong August for Markets

Markets continued to rally in August, with all three major U.S. indices setting record highs. The Dow Jones Industrial Average gained 1.50 percent, the S&P 500 notched a 3.04 percent return, and the Nasdaq Composite led with 4.08 percent.

These results came alongside improving fundamentals. According to Bloomberg Intelligence, as of August 27, the blended earnings growth rate for the S&P 500 in the second quarter was 95.9 percent (with 98 percent of companies having reported actual earnings). The current growth rate is above analyst estimates for a 65.9 percent increase.

Technical factors were also supportive; the major U.S. indices were above their respective 200-day moving averages. This marks 14 consecutive months with continued technical support as investors have remained positive about economic recovery.

International markets also had a solid month. The MSCI EAFE Index tracked U.S. markets and managed a 1.76 percent return. The MSCI Emerging Markets Index gained 2.65 percent.

Fixed income markets faced headwinds as rising long-term interest rates negatively affected bond prices. The 10-year U.S. Treasury yield increased from 1.20 percent at the start of the month to 1.30 percent at month-end. The Bloomberg U.S. Aggregate Bond Index declined by 0.19 percent.

High-yield fixed income, which is less affected by interest rate movements, had a positive month. The Bloomberg U.S. Corporate High-Yield Bond Index gained 0.51 percent. High-yield credit spreads declined, indicating investors were willing to accept slightly lower yields for investing in credit-dependent securities.

Medical Risks Continue to Increase

Despite the positive month for markets and an uptick in new vaccinations, medical risks continued to rise. New and total COVID-19 cases, as well as hospitalizations and positive test rates, climbed due to the Delta variant.

Despite rising medical risks, the effects of the worsening public health situation on the market and economy appear to be muted. Unlike last spring, we have not seen large-scale lockdowns or business restrictions. Unless we return to nationwide lockdowns, rising medical risks might not mean an increase in market or economic risks.

Economic Recovery Continues in August

Economic data released in August showed continued improvement. The July employment report highlighted ongoing labor market recovery strength, with 943,000 jobs added. And, although the August employment report, released on September 3, missed expectations—only 235,000 jobs were added versus an expected 733,000—it marked the eighth straight month of job growth.

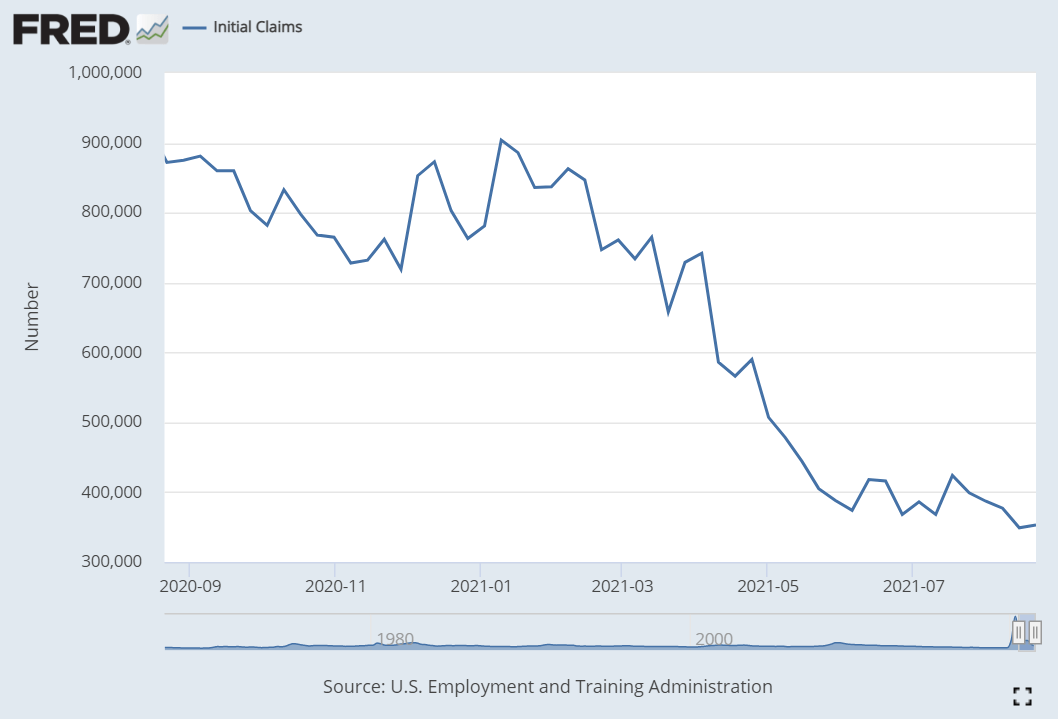

We also saw continued improvement in initial jobless claims, which set a pandemic-era low. As you can see in Figure 1, weekly layoff numbers have trended toward normal levels over the past year.

Figure 1. Initial Jobless Claims August 2020–Present

Consumer income and spending also improved: the latter increased by 0.3 percent and the former increased by 1.1 percent. Personal spending growth was encouraging, marking five consecutive months of increased spending. This resilience, despite potential pandemic-related headwinds, is reassuring.

For the housing sector, low mortgage rates and shifting homebuyer preference for larger properties served as a tailwind for faster sales (although a dearth of available homes and rising prices have hindered sales recently). The pace of existing home sales came in above expectations and hit a four-month high, and homes available for purchase reached the highest level since October 2020.

Businesses also exhibited signs of continued investment. The July durable goods orders report showed core durable goods increased more than expected. With business confidence above pre-pandemic levels and consistent consumer demand, high business spending is expected moving forward.

Risks Remain Despite Continued Economic Recovery

We are in a better place than a few months ago, but the recent surge in COVID-19 cases means we are not out of the woods yet. Rising medical risks could lead to further state and local restrictions, which could, in turn, affect consumer spending.

Also, negotiations in Washington regarding the size and timing of the next round of federal spending continue. Congress needs to address the debt ceiling, as the Treasury is using temporary emergency cash-conservation measures following the expiration of the two-year debt ceiling suspension in July. A debt ceiling increase or another debt limit suspension is likely, but potential federal default is possible.

Continued economic recovery seems promising, although risks that could drive short-term uncertainty persist. A well-diversified portfolio matching investor goals and time horizons remains ideal for most. As always, please reach out to us if you have any questions or concerns.

All information according to Bloomberg, unless stated otherwise. Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, manager, fixed income, at Commonwealth Financial Network®. © 2021 Commonwealth Financial Network®