Markets Pull Back in August

Equity markets fell in August as investors pulled back from riskier investments. The S&P 500 lost 1.59 percent, the Dow Jones Industrial Average lost 2.01 percent, and the Nasdaq Composite dropped 2.05 percent. Despite the modest August declines, all three major U.S. indices remained in positive territory for the quarter and year-to-date.

Market fundamentals continued to show slowing earnings growth. As of August 31, with 99 percent of companies having reported actual earnings, the blended earnings decline for the S&P 500 was 5.8 percent in the second quarter, according to Bloomberg Intelligence. Although this is better than the 9 percent drop anticipated at the start of earnings season, it was the largest quarterly earnings decline since the third quarter of 2020. Over the long run, fundamentals drive long-term performance, so weakening fundamentals are worth watching in the quarters ahead.

Technical factors were supportive, with all three indices finishing August well above their 200-day moving averages for the eighth consecutive month. The 200-day moving average is a widely followed technical signal; prolonged breaks above or below this level can signal shifting investor sentiment. Continued technical support was a positive signal that investors remain bullish on long-term prospects for the U.S.

International markets also saw losses. The MSCI EAFE Index fell 3.83 percent and the MSCI Emerging Markets Index tumbled 6.13 percent, bringing both below their respective 200-day moving averages by the middle of the month. The MSCI Emerging Markets Index ended August below its 200-day moving average, whereas the MSCI EAFE Index finished above trend thanks to a late-month rally.

Mixed Month for Fixed Income

Although results were negative across the board for equities, fixed income returns were mixed. Rising rates continued to weigh on investment-grade bonds during the month; the 10-year U.S. Treasury yield rose from 3.97 percent at the end of July to 4.09 percent at the end of August. The Bloomberg U.S. Aggregate Bond Index lost 0.64 percent.

High-yield fixed income, on the other hand, had a positive month. The Bloomberg U.S. Corporate High Yield Index gained 0.28 percent as high-yield bond returns were supported by falling credit spreads. Spreads reached 4 percent in mid-August before ending the month at 3.85 percent.

Returns to Highlight

- Bloomberg Aggregate Bond Index: down .64% in August 2023

- Bloomberg U.S. Corporate High Yield Index: up .28% in August 2023

Signs of Slowing Economic Growth Ahead

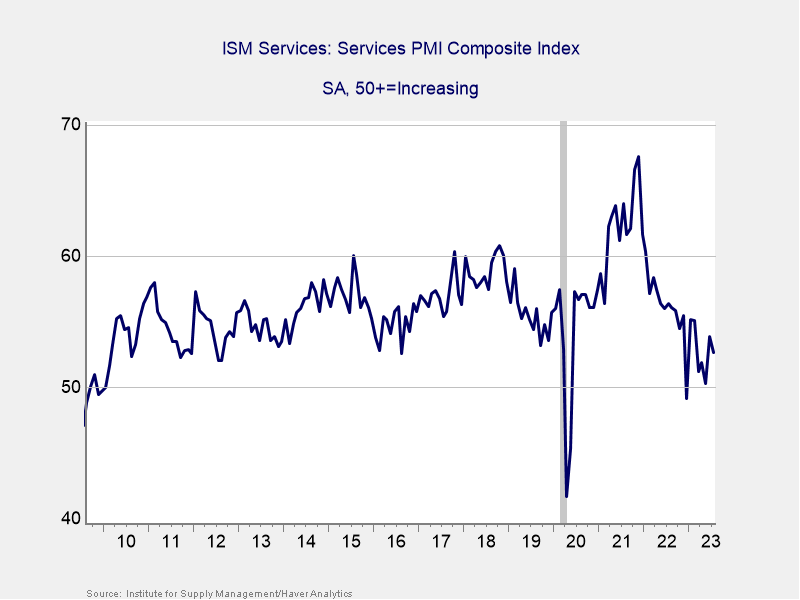

Economic growth may be set to slow in the second half of the year. Consumer and business confidence pulled back as rising concerns about the health of the economy weighed on consumers and business owners. As shown in Figure 1, service sector confidence fell in July and remains below highs from earlier in the year and throughout much of 2022.

Figure 1: ISM Services Index August 2009–Present

Source: Institute for Supply Management/Haver Analytics

Falling business confidence can lead to slower spending growth and hiring, so this will be an important area to monitor. Actual spending figures showed solid levels of personal and business spending in July, with personal spending and core durable goods orders growing more than expected.

Job growth also increased modestly, but this was due in part to a large negative revision to July’s employment report. In addition, the unemployment rate increased more than expected, with the 3.8 percent rate in August the highest since February 2022. Looking ahead, slowing job growth is expected, which contributed to rising expectations for slowing economic growth.

Although expectations for slower growth increased in August, it’s important to note that slower growth is still growth. In fact, it may be beneficial for markets and the economy over the long run because slower growth should support the Federal Reserve’s (Fed’s) efforts to combat inflation.

Risk assets rallied toward month-end as expectations for further rate hikes from the Fed declined. We ended the month with futures markets pricing in no additional rate hikes for the rest of the year.

The Fed is expected to remain data dependent at future meetings, so a potential slowdown in growth would support a pause in hikes for the rest of the year. Yields largely fell after Fed Chair Jerome Powell reinforced the central bank’s commitment to data dependence near the end of the month.

The Takeaway

- Signs of slowing growth appeared in August.

- Slowing growth should support the Fed’s attempts to combat inflation.

Market Risks Shifting

Although several headline-grabbing events shook markets in the first half of the year, many of those risks have faded. The debt ceiling stand-off and banking concerns from earlier in the year are good examples; both caused short-term volatility that has since dissipated. Looking ahead, market risks remain and should be monitored.

Domestically, inflation remains the largest risk because a spike in prices could lead to further rate hikes. Although this is not expected given the outlook for slowing growth, inflation will likely continue to be a primary risk for investors throughout the year. Weakening equity fundamentals are also a potential area of concern.

International risks should also be considered. The war between Russia and Ukraine could flare up and cause further market uncertainty in the second half of the year. In addition, there are concerns about the health of the Chinese economy; signs of slowing growth in the country could signal slower global growth ahead. The immediate market impact from these risk factors remains muted, but they remain areas of potential concern.

Finally, unknown risks always have the potential to negatively impact markets.

The Takeaway

- Inflation risks remain; a spike in prices could lead to Fed rate hikes that investors don’t expect.

- Weakening equity fundamentals are also a potential cause for concern.

- International and unknown risks remain and should be monitored.

Positive Long-Term Outlook

Despite the pullback for markets, the most likely path forward is continued economic growth and market appreciation for the rest of the year. Although expectations for slower growth increased, slower growth is still growth. On the whole, slowing growth may be a net positive over the long run if it helps tamp down inflationary pressure throughout the economy.

Of course, though continued economic growth and market appreciation are likely, the potential for short-term disruptions remains due to the very real risks faced by markets. As always, a well-diversified portfolio that matches investor timelines and goals remains the best path for most. If you have concerns, please reach out to us to discuss your current plan.

The Takeaway

- Slower economic growth is expected ahead, which could help combat inflation.

- Over the long run, the outlook remains positive despite the potential for short-term setbacks.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, director, fixed income, at Commonwealth Financial Network®. © 2023 Commonwealth Financial Network