Markets Pull Back

All three major U.S. indices tumbled in April. The S&P 500 lost 4.08 percent, the Dow Jones Industrial Average fell 4.92 percent, and the Nasdaq Composite dropped 4.38 percent. The sell-off, which was the first monthly decline this year after a strong first quarter for stocks, was primarily due to rising interest rates during the month.

Despite the declines, equity fundamentals improved in April. Per Bloomberg Intelligence, as of April 29, with 48 percent of companies having reported earnings, the average earnings growth rate for the S&P 500 in the first quarter was 4.9 percent. This exceeded analyst estimates at the start of earnings season for a more modest 3.8 percent increase. The better-than-expected earnings growth was widespread, with 10 of 11 sectors coming in above analyst estimates. This marks three consecutive quarters with solid earnings growth. Over the long run, fundamentals drive market performance, so solid earnings growth to start the year is a good sign for investors.

Technical factors were also supportive. All three major U.S. indices spent the entire month above their respective 200-day moving averages. The 200-day moving average is a widely monitored technical indicator because sustained breaks above or below this level can signal shifting investor sentiment for an index. Continued technical support throughout the month was another welcome development

for investors.

Results were mixed for international equities. The MSCI EAFE Index lost 2.56 percent in April. The MSCI Emerging Markets Index, on the other hand, rose 0.47 percent. Technical results were supportive for international stocks; both the MSCI EAFE and MSCI Emerging Markets indices spent the entire month above their respective 200-day moving averages.

Bonds Struggle

Bonds fell as rising interest rates pressured prices. The 10-year Treasury yield rose from 4.2 percent at the end of March to 4.69 percent at the end of April. A combination of faster economic growth and higher-than-expected inflation caused the rising interest rates. The Bloomberg Aggregate Bond Index lost 2.53 percent.

High-yield fixed income also experienced losses. The Bloomberg US Corporate High Yield Bond Index lost 0.94 percent. High-yield credit spreads were unchanged at 3.12 percent.

Returns to Highlight

- Bloomberg Aggregate Bond Index: down 2.53% in the month of April

- Bloomberg U.S. Corporate High-Yield Bond Index: down 0.94% in the month of April

Continued Economic Growth

Economic data released in April showed continued strong levels of economic growth. This was highlighted by the March employment report, which showed an impressive 303,000 jobs were added during the month, marking the largest monthly increase in 10 months and highlighting the continued strength of the labor market.

In addition, we saw continued consumer and business spending growth in March. Personal spending and retail sales increased more than expected, signaling impressively resilient consumer spending. This is a good sign for overall economic growth given the importance of consumer spending for the economy.

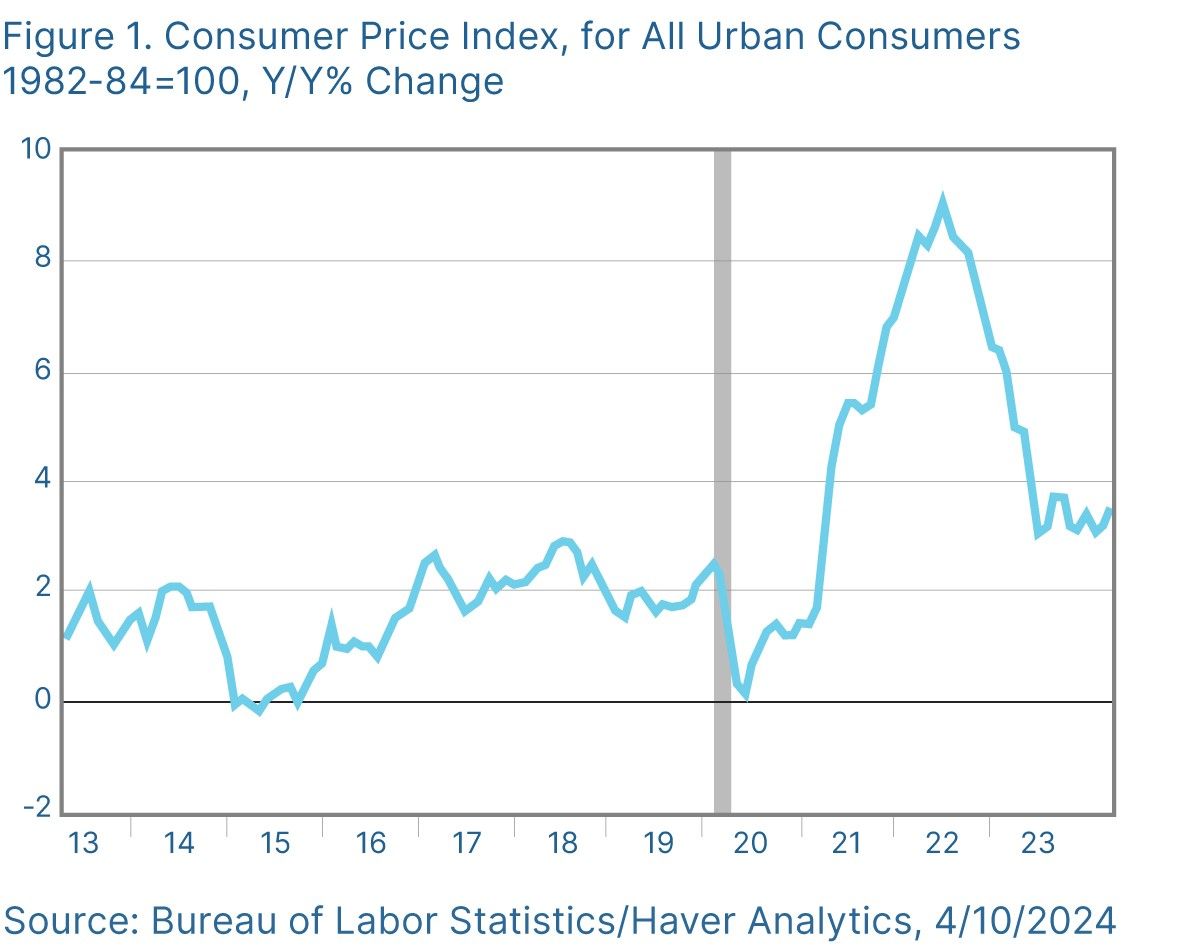

Although these impressive results were a welcome sign of healthy economic growth, the bad news is they contributed to stubbornly high levels of inflation. On a year-over-year basis, both headline and core consumer prices rose in March. As you can see in Figure 1, the pace of headline consumer price growth now sits at its highest level since September 2023; progress in getting inflation down has stalled.

The Takeaway

- Economic growth continued, highlighted by strong hiring and spending growth.

- Inflation remained stubbornly high in March, contributing to the rising interest rate environment.

Markets Rethink Interest Rates

Although strong economic growth to start the year was welcome for investors and economists, high levels of inflation in March were not. Investors spent most of April reassessing the proper level for long- and short-term interest rates in light of stronger economic growth and sticky inflation.

We started the month with futures markets pricing in a total of roughly 2.5 interest rate cuts by the end of the year, with the first cut anticipated at the Federal Reserve’s (Fed’s) July meeting. By the end of the month, markets were pricing in only one rate cut, scheduled for the Fed’s final meeting of the year in December. This is down notably from market expectations at the start of the year, when six interest rate cuts were anticipated.

The continued slide in market expectations for rate cuts throughout the year’s first four months was the major driver of the rise in interest rates over the same period. Although the changing expectations weighed on stock and bond prices in April, the good news is they should help limit future interest

rate–driven volatility because investors are no longer counting on more supportive monetary policy from the Fed in the months ahead.

The Takeaway

- Progress in combating inflation has stalled, causing investors to reassess their interest rate views.

- Market expectations for rate cuts this year dropped from six at the start of the year to only one.

Market Risks Remain

As we saw in April, inflation and the Fed remain primary risks for markets, especially if we see further price increases. With that being said, there are other risks worth monitoring. Domestically, we’re likely to see further economic and political uncertainty as we approach November elections.

Abroad, there are a number of risks as well, highlighted by continued conflicts in the Middle East that have the potential to strain supply chains. After starting the year at roughly $70 per barrel, oil prices reached a 2024 high of more than $87 in April.

Other risks to monitor include a slowdown in China and relatively high stock market valuations. And, as always, the potential for unknown risks to negatively affect markets remains.

The Takeaway

- Risks remain for markets, both domestically and abroad.

- Domestic risks include rising inflation and November elections, whereas continued conflict in the Middle East and slowing growth in China highlight foreign risks.

Fundamentals Remain Solid

Despite the declines in April, market and economic fundamentals remain healthy. Although rising inflation and interest rates caused a downturn, the outlook from here is positive.

The economic backdrop remains supportive, as shown by strong hiring and spending growth during the month. In addition, continued solid earnings growth in the first quarter indicates economic momentum from the end of 2023 has carried over into 2024. With consumers spending and businesses continuing to hire and invest, economic factors are expected to continue to support markets in the months ahead.

Nonetheless, April’s declines serve as a reminder that markets are still subject to several risks and that short-term disruptions can pop up anytime. Given the potential for short-term uncertainty, a well-diversified portfolio that matches investor goals and timelines remains the best path forward for most. If concerns remain, please reach out to us to discuss your financial plans.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. Authored by Brad McMillan, CFA®, managing principal, chief investment officer, and Sam Millette, director, fixed income, at Commonwealth Financial Network®. © 2024 Commonwealth Financial Network