April Showers for Markets

It was a rocky start to the spring for markets, with all three major U.S. indices ending the month in the red. The S&P 500 lost 8.72 percent in April while the Dow Jones Industrial Average (DJIA) dropped 4.82 percent. The Nasdaq Composite saw the largest drop as the index’s heavy weighting toward technology companies led to a 13.24 percent decline in April.

These losses offset March’s gains and came despite improving fundamentals. According to Bloomberg Intelligence, as of April 29, 2022, with 55 percent of companies having reported actual earnings, the average earnings growth rate for the S&P 500 in the first quarter sits at 8.7 percent.

All three major U.S. indices finished below their respective 200-day moving averages, marking three consecutive months where both the DJIA and Nasdaq finished below trend. It’s too soon to say if investors have soured on U.S. markets, but continued weakness is a potential cause for concern.

The MSCI EAFE Index fell 6.47 percent and the MSCI Emerging Markets Index dropped 5.55 percent. Concerns about slowing global growth and lockdown measures in China weighed on international investors. Technicals were weak; both international indices finished below their respective 200-day moving averages

The 10-year U.S. Treasury yield rose from 2.39 percent at the start of the month to 2.89 percent at month-end, bringing long-term rates to their highest level since late 2018. Short-term yields also increased, with the 3-month U.S. Treasury yield rising from 0.53 percent to 0.85 percent.

The Bloomberg U.S. Aggregate Bond Index fell 3.79 percent and the Bloomberg U.S. Corporate High Yield Index dropped 3.56 percent. High-yield credit spreads widened, signaling rising investor concern.

Fed Takes Center Stage

While average Covid-19 daily new case growth increased modestly, it remained below the Omicron-induced highs we saw in January. Future waves of infection are a possibility, but high levels of vaccination and prior exposure should help limit the impact.

Investors have become less focused on medical risks and more focused on challenges with returning to normal economic conditions. Consumer and producer prices have seen steady upward pressure, caused by tangled global supply chains, rising material and labor costs, and high levels of consumer and business demand. The war in Ukraine also added to global inflationary pressure.

To combat rising prices, the Federal Reserve (Fed) started its current cycle by announcing a 25 basis point interest rate hike at its March meeting, followed by a 50 basis point hike at the May meeting. The Fed is expected to raise rates at its remaining five meetings this year. The central bank will continue to monitor economic health as it tries to normalize policy.

Economic Updates Show Improvement

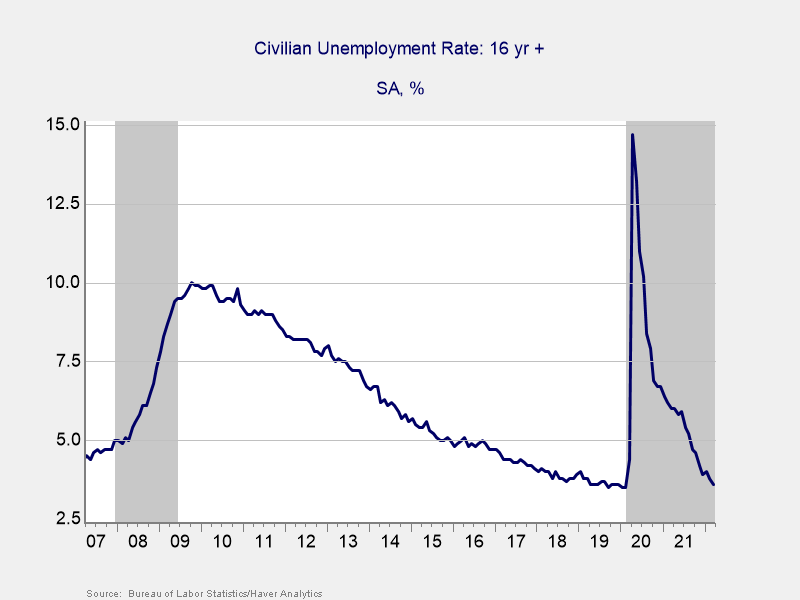

While rising rates can be a headwind for the economy and markets, economic fundamentals are still showing signs of improvement. As you can see in Figure 1, March’s 3.6 percent unemployment rate falls in line with pre-pandemic levels. This recovery was much faster than the labor market recovery following the great financial crisis.

Figure 1. Unemployment Rate, 2007–Present

The strong job market helped support income and consumer spending growth, as both reports came in above economist estimates. Retail sales growth also showed signs of improvement. While the first quarter GDP report showed the economy slowed to start the year, the underlying data was encouraging.

Business spending also showed improvement, with March’s core durable goods orders coming in above expectations following a surprise drop in February. Core durable goods orders increased in March at their fastest pace since April 2021.

The March building permits and housing starts reports came in above expectations, bringing the pace of new home construction to its highest level since 2006. The supply of existing homes for sale remains very low on an historical basis, so any new home construction growth is a healthy development.

Risks for Now but Continued Growth Ahead

April’s market drawdowns were a reminder that risks remain for markets. March’s start of the Fed’s hiking cycle and increased expectations for higher rates throughout the year are an example of the way shifting expectations can rattle markets. Uncertainty from the war in Ukraine could also add to future selloffs.

The most likely path forward for the U.S. economy remains continued growth. Economic fundamentals remain healthy, driven by job market improvements we’ve seen over the past two years. We may see economic setbacks in the months ahead, but improving fundamentals should support long-term growth.

As always, the potential for short-term market selloffs remains. It’s possible that we’ll see risks shift again in the upcoming months, which could add volatility. A well-diversified portfolio matching investor goals and timelines remains the best path forward for most. Reach out to us to discuss your financial plan if you have concerns.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, manager, fixed income, at Commonwealth Financial Network®. © 2022 Commonwealth Financial Network®