A positive quarter for markets, despite choppy September

Markets dropped early in September before partially recovering throughout the rest of the month. The S&P 500 fell by 3.80 percent, while the Dow Jones Industrial Average (DJIA) lost 2.18 percent and the Nasdaq Composite declined by 5.10 percent. Despite a disappointing September, all three indices ended the quarter in positive territory. The S&P 500 gained 8.93 percent in the third quarter, and the DJIA gained 8.22 percent. The Nasdaq led the way with an 11.24 percent increase.

These results were supported by improving fundamentals. According to Bloomberg Intelligence, the blended earnings growth rate for the S&P 500 fell by 31.1 percent in the second quarter. This was better than expectations for a 43.6 percent decline at the start of July and for a 32.8 percent decline at the end of August.

Technical factors were also supportive. All three major indices remained above their respective 200-day moving averages throughout September. While the technical support was welcome, the volatility during the month brought the indices closer to their respective trend lines.

The story was much the same internationally. The MSCI EAFE Index fell by 2.60 percent during the month but gained 4.80 percent for the quarter. The MSCI Emerging Markets Index declined by 1.58 percent for the month, but on a quarterly basis, it gained 9.70 percent. Both indices spent the month above their respective 200-day moving averages.

Fixed income markets were down slightly in September. The Bloomberg Barclays U.S. Aggregate Bond Index lost 0.05 percent but gained 0.62 percent for the quarter. Interest rates ended the quarter largely unchanged, with the 10-year Treasury yield starting and ending the period at 0.69 percent.

High-yield fixed income also had a challenging month. The Bloomberg Barclays U.S. Corporate High Yield Index fell by 1.03 percent during the month but gained 4.60 percent for the quarter.

Public health picture shows mixed results

The public health situation in the U.S. was mixed during the month and quarter. We saw a rise in cases in July, but we made progress in reducing local outbreaks in August and early September. Although the national case growth rate finished the quarter below July’s highs, we did see an uptick in cases toward the end of September. The increase has been gradual, but it signals that coronavirus risks may continue to rise as we head into the fall.

Testing showed progress during the month. The average number of tests increased, although daily test counts were volatile. The positive test rate fell in September and ended the quarter below the World Health Organization’s recommended 5 percent level.

Economic recovery continues at slower pace

Despite a strong rebound in spending earlier in the summer, the data releases in September showed a slowdown in growth. Looking forward, continued moderate growth remains likely.

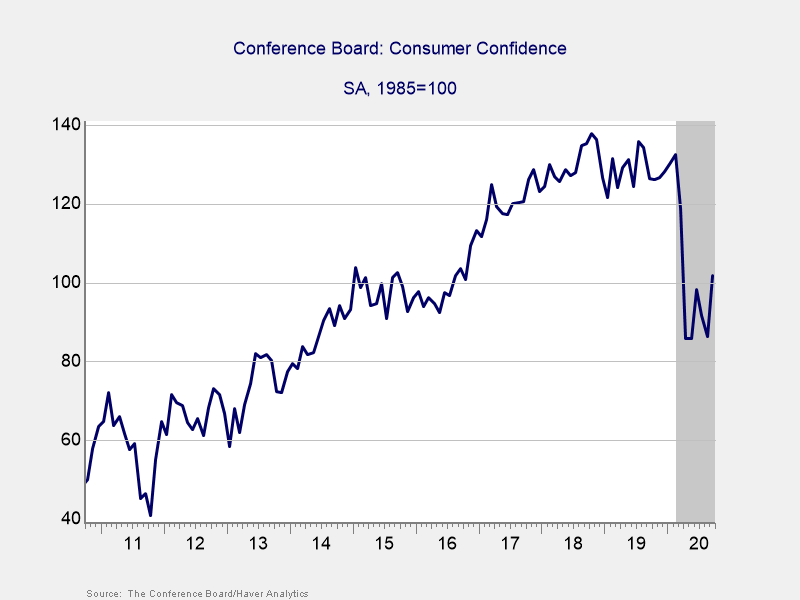

The Conference Board Consumer Confidence Index had its largest monthly increase in more than 17 years. As you can see in Figure 1, there is still a long way to go to get back to pre-pandemic levels, but this is a step in the right direction.

Figure 1. Conference Board Consumer Confidence

Consumer confidence was supported by improvements in the job market. More than 3.1 million jobs were added in July and August, bringing the total to more than 10.6 million additional jobs since reopening efforts began.

Businesses also showed continued growth during the month. Business confidence, as measured by the Institute for Supply Management Composite index, declined slightly but remained in expansionary territory. Durable goods orders and industrial production both increased but at a slower pace than earlier in the summer.

New and existing home sales both hit their highest level since 2006 in August. With rates remaining near record lows and home builder confidence at all-time highs, the housing sector is poised for growth heading into the fourth quarter.

Recovery continues, but risks are rising

Although infections are up, the pandemic is still under control. The economic risks are real, but the recovery is still moving forward. And while markets have been volatile, the fundamentals remain reasonably supportive. Given all of this, prospects are positive—but volatility may be on the horizon.

In these uncertain times, maintaining a well-diversified portfolio that matches investor goals and timelines is the best path forward for most investors. As always, if concerns remain, you should contact us to review your plans.

All information according to Bloomberg, unless stated otherwise.

Disclosure:Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Barclays Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg Barclays government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg Barclays U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, senior investment research analyst, at Commonwealth Financial Network®. © 2020 Commonwealth Financial Network®