Vaccine news boosts markets in November

November was a strong month for markets, as news about developmental vaccines for the coronavirus caused markets to surge. The S&P 500 gained 10.95 percent in November, the Nasdaq Composite rose by 11.91 percent, and the Dow Jones Industrial Average gained 12.14 percent gain.

These strong results were accompanied by improving fundamentals. According to Bloomberg Intelligence, as of November 24 with 97 percent of companies having reported results, the blended third-quarter earnings decline for the S&P 500 sits at 7.3 percent. This is notably better than analyst estimates for a 21.5 percent drop.

Technical factors were also supportive for markets. The three major indices remained above their respective 200-day moving averages in November, marking five straight months where all three indices finished above trend. The continued technical support for equity markets since reopening efforts took hold indicates that investors remain confident in U.S. companies and their ability to withstand the pandemic.

The story was much the same internationally. Positive vaccine news pushed global equity markets higher. The MSCI EAFE Index gained an impressive 15.50 percent in November. Emerging market investors also celebrated the vaccine news, with the MSCI Emerging Markets Index gaining a strong 9.25 percent. Both of these indices finished the month above their respective 200-day moving averages.

Fixed income also had a positive month, supported by falling interest rates. The 10-year Treasury yield decreased from 0.88 percent at the end of October to 0.84 percent at the end of November. The Bloomberg Barclays U.S. Aggregate Bond Index gained 0.98 percent. High-yield bonds, which are typically less tied to movements in rates, also had a positive month. The Bloomberg Barclays U.S. Corporate High Yield Index returned 3.96 percent in November. High-yield spreads narrowed to their lowest level since February, indicating that investors’ tolerance for higher-yielding, riskier securities rose during the month.

Medical risks remain, but signs for hope emerge

November was a mixed bag for public health, yet there are reasons for optimism. COVID-19 case counts continued to rise, but the pace of case growth slowed near month-end. We saw continued growth in daily testing throughout November. The positive test rate started to decline by month-end, showing we are doing a better job of identifying and addressing new infections.

With that being said, there are still very real risks on the medical front. The potential for an increased infection rate following the Thanksgiving holiday is a primary concern.

Economic recovery continues at slower pace

The economy continued to grow in November, but there were signs that rising case counts served as a headwind. Consumer spending, one of the bright spots in the economic recovery, showed continued growth. October’s retail sales and personal spending reports, however, marked their lowest monthly growth levels since lockdowns were lifted. In addition, both major measures of consumer confidence fell by more than expected in November.

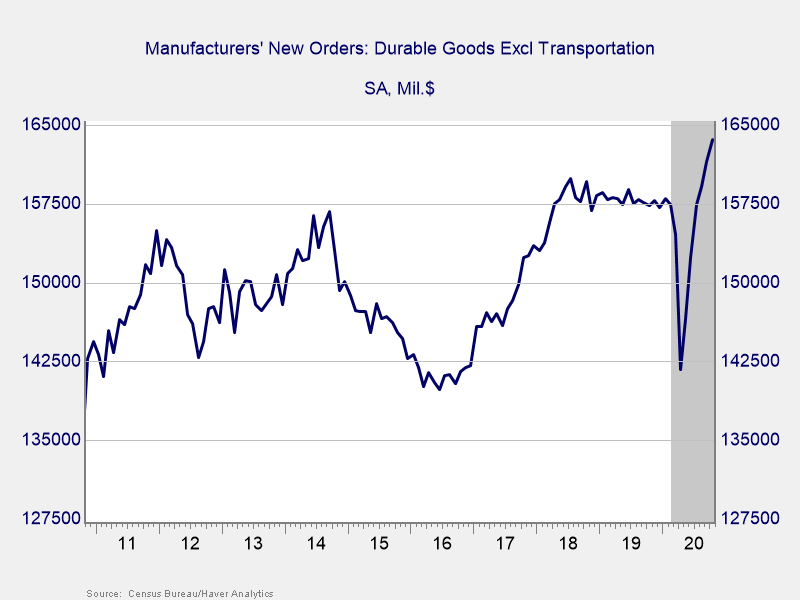

Manufacturer and service sector confidence remained near or above pre-pandemic levels. This confidence translated into faster business spending, with the durable goods orders report for October coming in above expectations. Core durable goods orders, which strip out the impact of volatile transportation orders, were especially impressive. They rose by 1.3 percent during the month against forecasts for more modest 0.5 percent growth. As you can see in Figure 1, core orders have rebounded well past pre-pandemic levels.

Figure 1. Core Durable Goods Orders, November 2010–Present

Good news, but risks remain

As we saw in November, medical concerns still present a risk to the continued economic recovery. Political risks also remain, despite the conclusion of the November elections. But vaccines are coming, and while the economy may have slowed, it’s still growing. Strong earnings results are a sign that companies are adapting. The continued market rally says investors think things will get better—but volatility is always a possibility. A well-diversified portfolio that matches investor goals and timelines remains the best path forward for most. If concerns remain, however, contact us to review your financial plans and goals.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Barclays Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg Barclays government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg Barclays U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, senior investment research analyst, at Commonwealth Financial Network®. © 2020 Commonwealth Financial Network®