Markets continue to recover in May

May saw equity markets around the world rise for the second month in a row. The Dow Jones Industrial Average (DJIA) rose by 4.66 percent, and the S&P 500 gained 4.76 percent. The Nasdaq Composite led the way with a 6.89 percent gain.

These strong results came despite worsening fundamentals. According to Bloomberg Intelligence, as of May 29, the first-quarter blended average earnings growth rate for the S&P 500 sat at –16.5 percent. This would mark the worst quarter for earnings since the second quarter of 2009.

From a technical perspective, May was a mixed month for U.S. markets. Both the S&P 500 and the Nasdaq finished the month above their respective 200-day moving averages. The DJIA was the outlier, remaining below its trendline.

The story was much the same internationally. The MSCI EAFE Index gained a solid 4.35 percent, and the MSCI Emerging Markets Index increased by 0.79 percent. Technicals remained challenging for international markets. Both the EAFE and emerging markets indices remained well below their trendlines.

Fixed income markets had a solid month, benefiting from continued low interest rates and supportive policy from the Federal Reserve. The 10-year Treasury yield remained largely unchanged, starting May at 0.64 percent and finishing the month at 0.65 percent. The Bloomberg Barclays U.S. Aggregate Bond Index returned 0.47 percent. The Bloomberg Barclays U.S. Corporate High Yield Index gained an impressive 4.41 percent in May.

Continued progress in combating coronavirus bolsters reopening

May saw continued progress in slowing the spread of the coronavirus, leading many states to begin reopening efforts. The month-end growth rate of roughly 1.5 percent is significantly lower than the peak of roughly 5 percent growth we saw in April. In addition, the daily average test counts increased by roughly 50 percent in the last week of May compared with the last week of April. The percentage of positive tests fell below the crucial 10 percent level that experts say indicates there is enough testing in a population.

One of the most notable things we did not see during the month was a surge in new infections toward month-end. This shows that efforts to reopen economies in some states have not had an immediate impact on the number of new cases. As a result, hopes are rising that a dreaded second wave of infections may be avoidable if the pace of reopening remains measured.

Economic data indicates the worst may be behind us

Much of the economic data released in May was backward looking and showed the impact anti-coronavirus efforts had on the economy. There are signs the worst of the economic damage may now be behind us, however. Roughly 20.5 million jobs were lost in April, but the pace of layoffs has decreased for eight straight weeks. And, a surprise decline in continuing unemployment claims midmonth suggests workers are going back to their jobs.

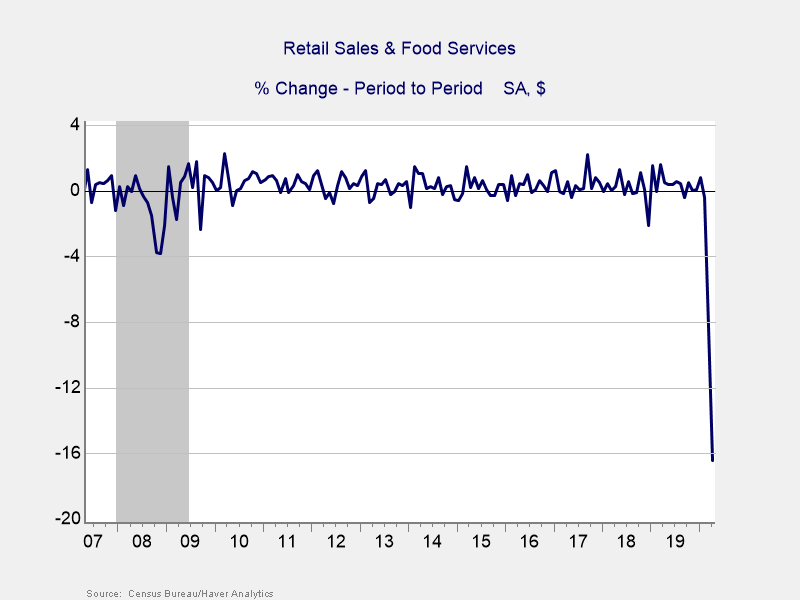

Consumer spending was weak during the month. April’s retail sales fell by 16.4 percent. As you can see in Figure 1, this fall in sales is unprecedented in recent history.

Figure 1. Retail Sales, 2007–Present

Both major measures of consumer confidence increased modestly in May. We’ve also seen increases in restaurant bookings and mobility in places where reopening efforts have begun. Businesses showed some signs of stabilization, with manufacturer and service sector confidence falling by less than expected in April. Core durable goods orders fell by much less than expected as well.

Real risks remain despite continued progress

Although we did not see a surge in coronavirus cases in May, there is still potential for a second wave and a return to shelter-in-place orders. Beyond the effects of the virus on the economy and markets, worsening trade relations between China and the U.S. could cause more volatility. The rising social unrest in the U.S. may have an effect as well.

Markets are currently pricing in a best-case-scenario outlook, so any negative news could rattle investors and drive volatility. With that in mind, maintaining a well-diversified portfolio that matches investor goals and timelines remains the best path forward for most; however, you should consult with your financial advisor if concerns remain.

####

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Barclays Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg Barclays government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg Barclays U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, senior investment research analyst, at Commonwealth Financial Network®. © 2020 Commonwealth Financial Network®