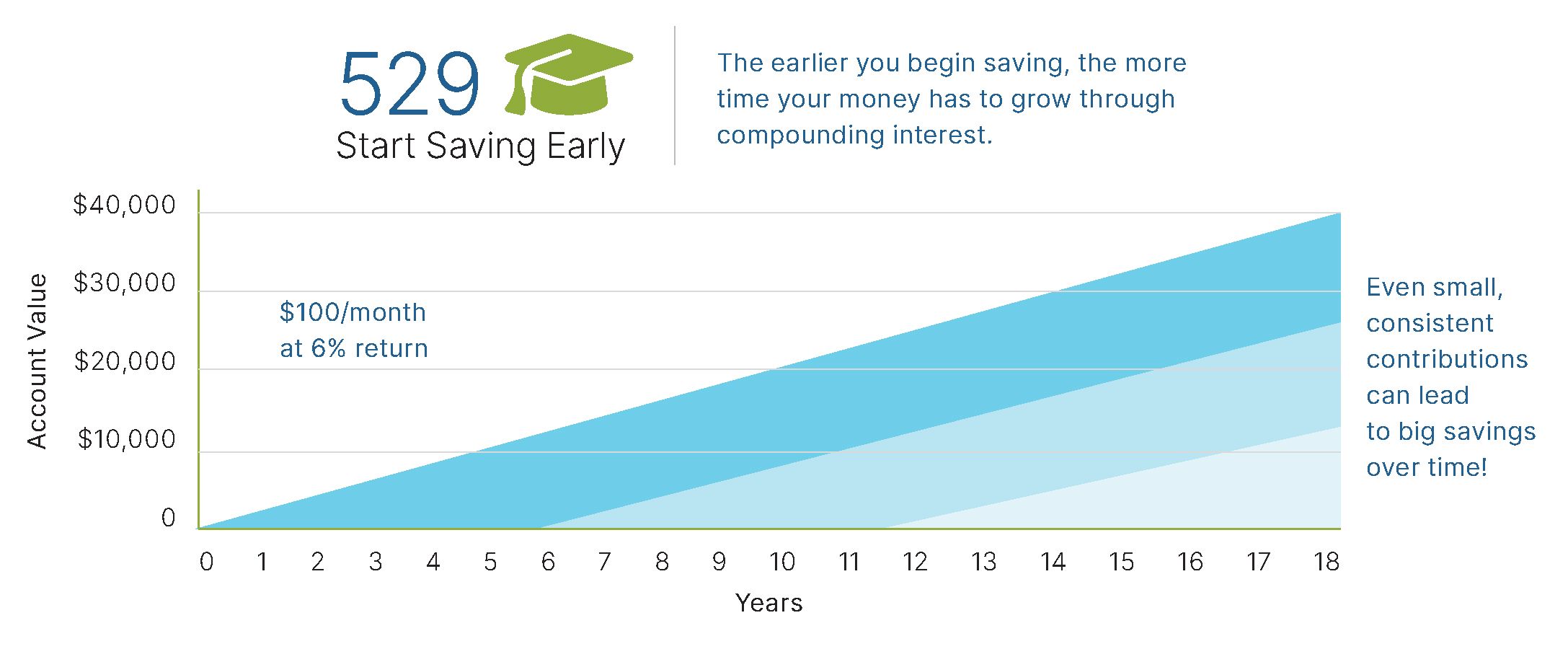

Every parent wants to give their child the best possible future, and for many families, that includes higher education. But with tuition costs continuing to rise, figuring out how to pay for college can feel overwhelming. The good news? Starting a college fund early gives your savings more time to grow, making it easier to manage those future expenses.

The fees, expenses, and features of 529 plans can vary from state to state. 529 plans involve investment risk, including the possible loss of funds. There is no guarantee that an education-funding goal will be met. In order to be federally tax free, earnings must be used to pay for qualified education expenses. The earnings portion of a nonqualified withdrawal will be subject to ordinary income tax at the recipient’s marginal rate and subject to a 10 percent penalty. By investing in a plan outside your state of residence, you may lose any state tax benefits. 529 plans are subject to enrollment, maintenance, and administration/management fees and expenses. This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation. © 2025 Commonwealth Financial Network®