Markets Rebound in October

Equity markets improved in October, helping offset September losses. The S&P 500 gained 8.1 percent, while the Nasdaq rose 3.94 percent. The Dow Jones Industrial Average (DJIA) experienced the best month of the three major indices, soaring 14.07 percent.

That positive performance coincided with improving fundamentals. As of October 31, with 53.6 percent of companies having reported actual earnings, the blended earnings growth rate for the S&P 500 in the third quarter was 3.8 percent, according to Bloomberg Intelligence. (At the start of earnings season, the rate was expected to be 2.6 percent.)

Technical factors were mixed. The S&P 500 and Nasdaq finished well below their 200-day moving averages, marking seven consecutive months with both finishing below trend. The DJIA, on the other hand, ended above trend for the first time since March. The 200-day moving average is important because prolonged breaks above or below it can signal shifting investor sentiment for an index.

International equities were also mixed. The MSCI EAFE Index increased 5.38 percent, while the MSCI Emerging Markets Index lost 3.09 percent. Technical factors for developed and emerging markets were challenging; both indices finished below trend. In fact, they have ended every month this year below their respective 200-day moving averages, indicating continued investor unease with international stocks.

Fixed income markets continued to experience losses due to rising interest rates. The 10-year Treasury yield rose from 3.83 percent to 4.1 percent, marking the first time the 10-year yield finished a month above 4 percent since May 2008. The Bloomberg Aggregate Bond Index declined 1.3 percent. High-yield credit spreads declined notably, dropping from 5.43 percent to 4.63 percent. Those declining credit spreads helped the Bloomberg U.S. Corporate High Yield Index gain 2.6 percent.

Interest Rate Uncertainty Remains

Interest rate volatility continued, as investors remained concerned about higher rates from the Federal Reserve (Fed) in the short term. The Consumer Price Index showed that consumer inflation accelerated, leading to higher fixed income yields due to expectations for additional Fed rate hikes.

Housing Continues to Slow

Existing home sales declined in September for the ninth consecutive month. The annualized pace of existing home sales is at its lowest since Covid lockdowns began in 2020. Mortgage rates continued to rise, ending the month at 7.22 percent. In a sign that the sales slowdown has begun to affect prices, the Case-Shiller 20-City Composite Home Price Index fell 1.3 percent in August.

Economy Remains Solid

Despite the slowdown for the housing sector, overall economic growth remained on track. The advanced estimate for third-quarter GDP showed that the economy grew at an annualized rate of 2.6 percent, better than economist estimates and an encouraging rebound after two quarters of contraction.

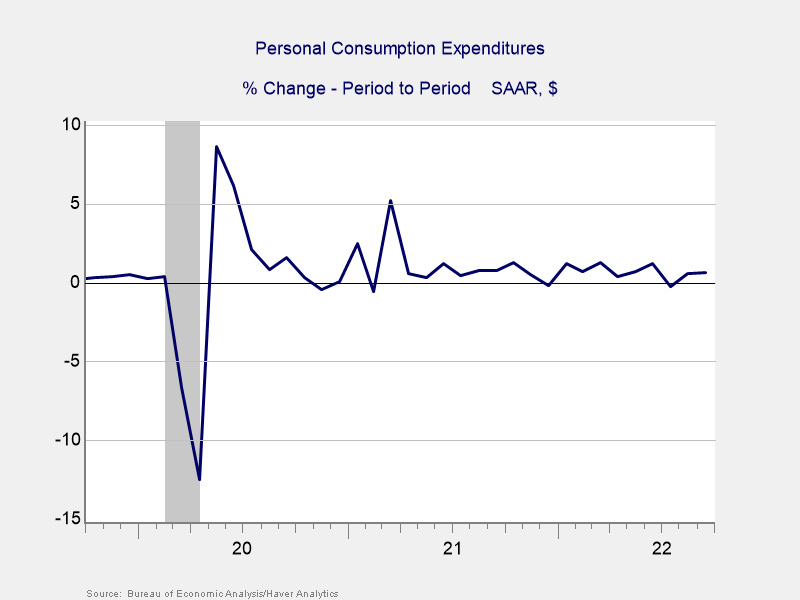

September saw 263,000 jobs added, surpassing expectations. This helped drive the unemployment rate to a pandemic-era low of 3.5 percent. September’s personal spending report showed that consumer spending held up well. In fact, as shown in Figure 1, consumer spending remained resilient during the month and has been largely consistent this year.

Figure 1. Personal Spending, October 2019–Present

Business spending also remained healthy; headline durable goods orders increased in September, and August results were revised upward.

Risks Cloud Short-Term Outlook

Market and economic updates were positive, but risks remain. November midterm elections could lead to market turbulence. The Fed also remains a risk because it could scare investors and cause further interest rate instability if it plans to raise interest rates higher for longer.

Several risks remain abroad, with the continued Russian invasion of Ukraine a primary one. The slowdown in China and tighter monetary policy globally may also affect the U.S. economy and markets.

Despite these risks, market resilience was a positive development that signals many of the dangers may already be priced in. With fundamentals improving, downside risks may be contained.

Ultimately, though the potential for short-term turbulence remains, continued growth remains the most likely outcome over the medium to long term. A well-diversified portfolio that matches investor timelines with goals remains the best path forward for most. As always, if concerns remain, reach out to us to discuss your plan.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. One basis point is equal to 1/100th of 1 percent, or 0.01 percent. The Case-Shiller 20-City Composite Home Price Index tracks changes in the price of residential real estate in 20 major metropolitan regions in the U.S. Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, manager, fixed income, at Commonwealth Financial Network®. © 2022 Commonwealth Financial Network®