June Selloff Adds to Challenging Quarter for Markets

Equity markets experienced widespread selloffs in June. Fears of a potential recession and high inflation weighed heavily on investors, capping off a challenging second quarter. All three major U.S. indices ended the month and quarter down: the S&P 500 lost 8.25 percent (month) and 16.1 percent (quarter); the Dow Jones Industrial Average lost 6.56 percent (month) and 10.78 percent (quarter); and the Nasdaq Composite lost 8.65 percent (month) and 22.28 percent (quarter).

Per Bloomberg Intelligence, as of June 17, 2022, with 99.8 percent of companies having reported actual earnings, the average first-quarter earnings growth rate for the S&P 500 was 9.01 percent. This is up from estimates for a 5.19 percent increase and represents solid quarterly earnings growth for the index.

Technical factors were a headwind for U.S. equity markets during the month and quarter with all three major U.S. indices under their respective 200-day moving averages. While it’s too soon to say if investors have soured on U.S. equities, second-quarter technical weakness was a potential cause for concern.

The story was much the same internationally. The MSCI EAFE Index lost 9.28 percent (month) and 14.51 percent (quarter) while the MSCI Emerging Markets Index lost 6.56 percent (month) and 11.34 percent (quarter). Both indices remained well below their 200-day moving averages for almost the entire period.

Even fixed income struggled as rising interest rates caused prices for previously issued bonds to fall. The 10-year U.S. Treasury yield started at 2.39 percent, rose to 3.49 percent, and fell to 2.98 percent. The Bloomberg U.S. Aggregate Bond Index declined 1.57 percent (month) and 4.69 percent (quarter).

High-yield fixed income also struggled; the Bloomberg U.S. Corporate High Yield Bond Index dropped 6.73 percent in June, which contributed to a 9.83 percent loss for the quarter. High-yield credit spreads rose from 3.40 percent at the start of the quarter to 5.87 percent by the end of June.

Recession and Inflation Spook Investors

Second-quarter market underperformance was largely driven by investor concerns about inflation. The Federal Reserve (Fed) spent the quarter trying to combat inflation by tightening monetary policy, and the central bank plans on continuing to hike rates until there is evidence of inflation slowing. Higher interest rates caused markets to reprice equities and fixed income investments.

There were signs that the worst impact from inflation may be behind us in June, including evidence that inflation is starting to slow due to improved supply chains and energy costs. We also saw long-term interest rates decline, which is a sign that investors are less concerned about long-term high inflation.

Economy Continues to Grow

Economic data releases showed signs of growth. Hiring was strong for the month and quarter, with the May job report showing 390,000 added jobs and a 3.6 percent unemployment rate. This is largely in line with the pre-pandemic low of 3.5 percent and highlights progress since Covid-19 lockdowns in 2020.

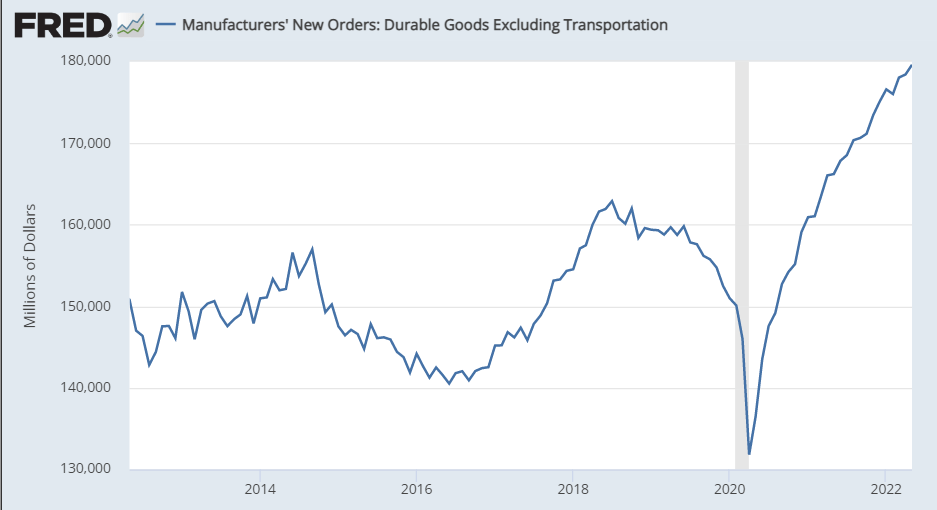

The healthy labor market and wage growth supported consumer spending growth during the month and quarter, although there were signs of retail and personal spending growth slowing in May. Business spending was also healthy throughout the month and quarter as business owners continued to invest in their businesses to meet high levels of demand. As you can see in Figure 1, core durable goods orders increased throughout the quarter and ended May well above pre-pandemic levels.

Figure 1. Manufacturer’s Now Orders: Durable Goods Excluding Transportation, 2012–Present

Housing was one of the best performing sectors early in the pandemic—due to record-low mortgage rates and shifting home buyer preference for larger single-family homes—but 2022 has been another story. The average 30-year mortgage rate increased from 3.3 percent at the start of the year to 5.83 percent in June, which weighed on prospective home buyers and the pace of housing sales.

The pace of existing home sales peaked at an annualized rate of 6.49 million sales in January but dropped every month since and ended May at 5.41 million. This is largely in line with pre-pandemic levels and a sign that the Fed’s attempts are starting to work. While slowing housing sales growth hasn’t impacted prices, the headwind from higher rates is expected to slow sales growth and price appreciation.

Risks Remain, as Do Solid Fundamentals

Selloffs in June were a reminder that risks remain for markets and the economy, mostly inflation, interest rates, and the Fed. Despite recent market turbulence, it’s important to remember that economic fundamentals are sound and continued growth is the most likely outcome in the months ahead.

The Fed’s plan to tighten monetary policy will continue to present a risk for markets, especially if the central bank surprises investors with the timing and size of further rate hikes. While the pandemic’s effect on markets diminished, it still represents a potential risk factor to monitor. Although geopolitical risks stabilized in June, the war in Ukraine and ongoing lockdown in China could negatively affect markets.

Despite risks to markets and the economy, the strong labor market and continued business and consumer spending are signs that core fundamentals are strong and economic recovery remains on track. While this was certainly a painful start to the year for investors, markets have priced in much of the negative news and we may be approaching a turning point; slow growth is still growth.

The pace of economic expansion is still uncertain, and we’re likely to see periods of turbulence. A well-diversified portfolio that matches investor goals and timelines remains the best path forward for most; however, you should reach out to us to discuss your financial plan if you have concerns.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, manager, fixed income, at Commonwealth Financial Network®. © 2022 Commonwealth Financial Network®