Markets Slide in February

Markets sold off in February, driven by continued concerns about inflation and the Russian invasion of Ukraine. The S&P 500, Dow Jones Industrial, and Nasdaq Composite dropped 2.99 percent, 3.29 percent, and 3.35 percent, respectively. This marked two consecutive months with losses to start the year for all three indices.

Despite this selloff, fundamentals showed continued improvement. According to Bloomberg Intelligence, as of February 25, with 95 percent of companies having reported fourth-quarter earnings, the average earnings growth rate for the S&P 500 was 28.5 percent—up from estimates for a 19.8 percent increase.

Volatility turned technical factors for equities negative in February. All three major U.S. indices finished below their 200-day moving averages, marking the first time they all finished below trend since March 2020. It will be important to determine if investor sentiment has soured on U.S. markets or if recent declines were a temporary market reaction.

The story was much the same internationally; the MSCI EAFE Index declined 1.77 percent and the MSCI Emerging Markets Index was down 2.98 percent. Technicals were challenging for international markets as well, with indices ending below their respective 200-day moving averages.

Fixed income markets were also down. The 10-year U.S. Treasury yield started at 1.81 percent, reached 2.05 percent, and finished at 1.83 percent. The rate increase was prompted by concerns about inflation and the Federal Reserve (Fed)’s anticipated rate hike in March, followed by a flight to quality trade due to the Russian invasion.

The Bloomberg U.S. Aggregate Bond Index ended down 1.12 percent and the Bloomberg U.S. High Yield Corporate Index dropped 1.03 percent. High-yield credit spreads widened to their highest month-end level since January 2021, indicating rising investor concern.

Risks Shift Throughout the Month

February saw rapid changes in the risks driving markets. Early on, declining medical risks supported an equity market rebound following declines in January. Concerns about inflation and the Fed’s monetary policy plans then rattled markets before the Russian invasion at added more uncertainty.

We saw a significant decline in daily new Covid-19 cases and the 7-day moving average ended February at its lowest level since July 2021 along with falling daily deaths and hospitalizations. With 65 percent of the country fully vaccinated and an additional 12 percent having received at least one shot—on top of growing natural immunity—last month’s improvement suggests medical risks are likely to keep declining.

The January Consumer Price Index (CPI) report showed consumer prices increasing at their fastest pace since 1982. The Russian invasion of Ukraine caused increased uncertainty for markets—especially energy. While the invasion’s initial impact on U.S. equities was muted, the situation remains in flux. February’s shifts are a reminder that unexpected risks can suddenly appear and shake markets.

Economic Data Improves

The January employment report showed 467,000 jobs added, better than 125,000 expected. November and December jobs reports were revised up a net 709,000 new jobs. Personal spending and retail sales were above expectations in January, offsetting December’s Omicron-induced declines. Retail sales and personal spending grew 3.8 percent and 2.1 percent, respectively.

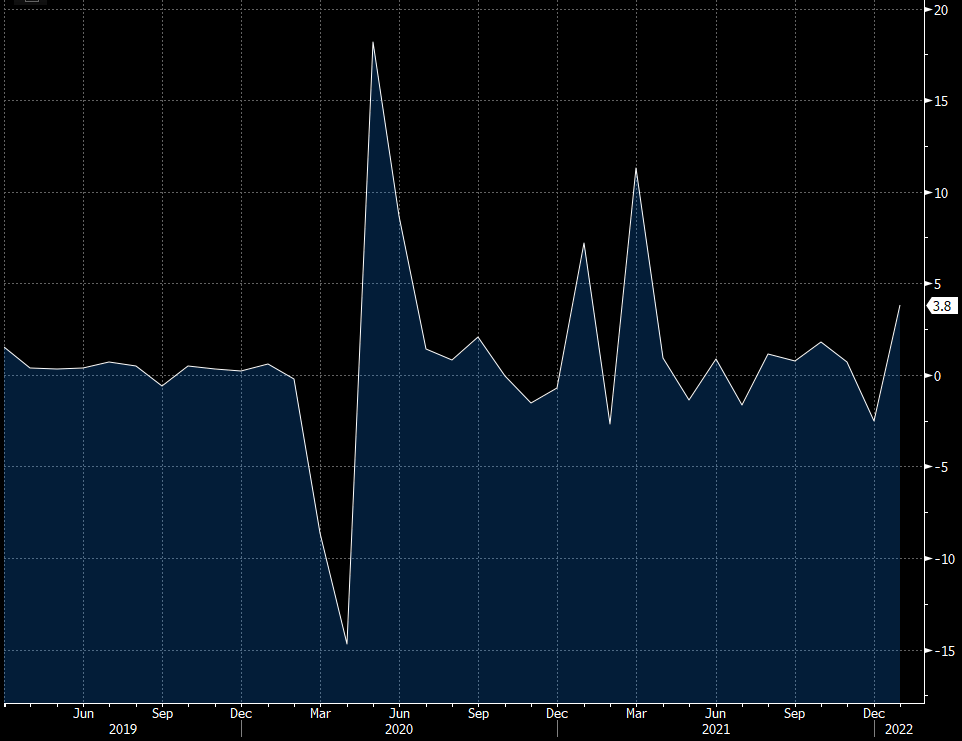

As shown in Figure 1, this represents the best month for retail sales growth since March 2021 when federal stimulus checks spurred spending.

Figure 1. Retail Sales Monthly Percentage Change, March 2019-Present

Business confidence declined but remained in healthy expansionary territory. Core durable goods orders increased in January, marking 11 consecutive months with high business spending. Home builder confidence was solid in February due to high levels of potential home buyer demand. January’s existing home sales report showed faster-than-expected growth and existing home sales pace hit a one-year high.

Risks Remain but Growth Is Likely

The war between Russia and Ukraine will be a major factor for political and economic uncertainty, even if economic and market impacts have been muted in the U.S. thus far. Medical risks dropped in February, but we could see new waves of Covid-19. High inflation could also push rates higher and lead to more volatility.

Fundamentals for businesses and the economy remain strong. While negative headlines and geopolitical events can draw investor attention and lead to short-term selloffs, improving fundamentals should be supportive. A well-diversified portfolio that matches investor timelines and goals remains the best path forward for most investors. As always, reach out to us to review your financial plans.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, manager, fixed income, at Commonwealth Financial Network®. © 2020 Commonwealth Financial Network®