Solid July for Markets

July was a positive month for most markets despite rising medical risks. The three major U.S. indices saw all-time highs as the Nasdaq Composite gained 1.19 percent, the Dow Jones Industrial Average gained 1.34 percent, and the S&P 500 gained 2.38 percent.

These positive returns coincided with more good news on the earnings front. According to Bloomberg Intelligence as of July 30, the second-quarter blended earnings growth rate for the S&P 500 was 89 percent (with 59 percent of companies reporting results). The current rate is higher than analyst estimates of a 65.9 percent increase.

Technical factors also supported domestic markets as all three indices remained above their respective 200-day moving averages for the 13th consecutive month. Despite medical risks, investors remain confident in the ongoing economic recovery in the U.S.

On the international side, the MSCI EAFE Index experienced volatility but gained 0.75 percent. The Delta variant spooked emerging investors, and the MSCI Emerging Markets Index ended July down by 6.67 percent.

From a technical perspective, the MSCI EAFE Index remained above its 200-day moving average for the ninth straight month. The MSCI Emerging Markets Index fell, ending below its trend line and breaking a 12-month streak of finishing above the 200-day moving average—a potential sign of more risk for emerging markets.

Fixed income markets also had a strong July as falling interest rates caused bond prices to rise. The 10-year U.S. Treasury yield fell from 1.48 percent to 1.24 percent, the lowest month-end level for the 10-year yield since January. The Bloomberg Barclays U.S. Aggregate Bond Index ended the month with a 1.12 percent gain.

High-yield fixed income had a slightly muted month, with the Bloomberg Barclays U.S. Corporate High Yield Index increasing by 0.38 percent. High-yield credit spreads widened modestly, a sign that investors became more cautious.

Medical Risks Rising but Still Contained

Despite progress throughout the year, the Delta variant drove increased medical risks in July; the average number of daily new cases grew by roughly five times and COVID-related hospitalizations reached a five-month high. This is something to monitor, but prevalent vaccinations and mask wearing in the majority of the country points to resurgence once again being controlled.

Economic Recovery Slowing but Solid

Although medical risks rose, their impact on the economic recovery is likely to be muted compared with last spring. With outbreaks limited by area, nationwide and localized shutdowns appear unnecessary. Even though growth is likely to continue, there are signs of slowing. Labor market recovery has decelerated as layoffs remained high and started to climb toward month-end. We’ve also seen business confidence pull back from record-high levels earlier in the year.

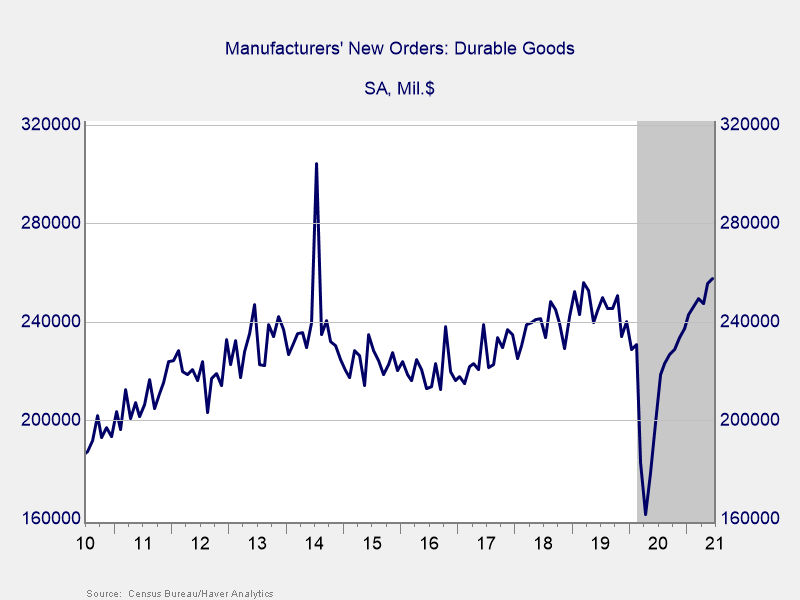

The economy still has momentum, however, and continued growth remains likely. The Conference Board Consumer Confidence Index increased and brought consumer confidence in line with pre-pandemic levels. Also encouraging is business confidence—while below recent highs, it’s still at very healthy levels. As you can see in Figure 1, the total level of durable goods orders has recovered past pre-pandemic levels.

Figure 1. Durable Goods Orders, 2010–Present

The fundamentals are still positive as both consumers and businesses remain confident. As long as most of the country remains open, growth should continue.

Rising Risks Indicate Caution Is Warranted

We are in a better place as a country on both public health and economic fronts than we were even a couple of months ago. Though the spike in medical risks has not yet caused significant economic or market impact, July reminds us that real risks to recovery remain. The key question will be whether localized infection rates lead to another national wave.

Negotiations on the potential infrastructure deal from Washington have also caused uncertainty. Congress addressing the federal debt limit could lead to a government shutdown as early as October. Although political risks are not immediate, uncertainty has the potential to weigh on investors and markets.

While risks may soon prompt increased ambiguity and instability, it’s important to focus on the bigger picture. A well-diversified portfolio that matches goals and timelines remains the best path forward for most investors. If you have concerns, please, reach out to us.

All information according to Bloomberg, unless stated otherwise.

Disclosure:Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Barclays Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg Barclays government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg Barclays U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, manager, fixed income, at Commonwealth Financial Network®. © 2021 Commonwealth Financial Network®